In the ever-changing world of cloud computing, mastering financial management is crucial for organizations. FinOps is an intriguing concept that is key to unlocking efficient cloud spending. With global cloud spending projected to reach $591.8 billion in 2023, according to Gartner, embracing FinOps is essential for staying competitive. By implementing Cloud Financial Management practices, companies can achieve remarkable cost reductions of up to 30% while fostering agility and driving innovation. How did it happen? Let’s figure it out!

What Is Cloud FinOps?

Derived from “financial management” fusion with DevOps, FinOps represents a dynamic and evolving discipline in cloud financial management.

FinOps is a management approach that advocates for collaborative responsibility over an organization’s cloud computing infrastructure and expenses. More than just a practice, it has evolved into a cultural mindset that fosters seamless collaboration among engineering, finance, technology, and business teams, all driven by data-driven spending decisions.

Unlock the Power of Cloud Financial Management

From track spending and data-driven budget decisions to turbocharging ROI and gaining financial agility, there are five compelling reasons why every organization should implement FinOps. It’s time to unleash the true potential of your business and embark on a journey of optimized financial outcomes and unparalleled success.

#1 Accurate Spending Tracking

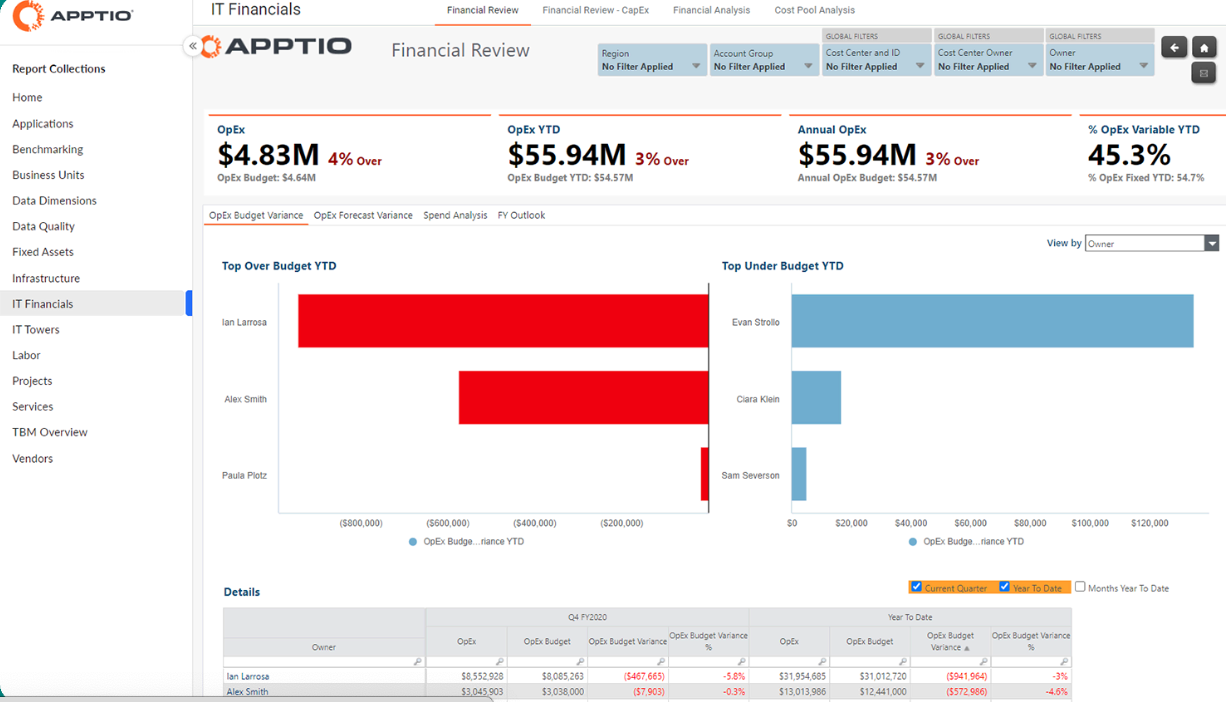

According to McKinsey, organizations that use FinOps effectively can reduce cloud costs by as much as 20 to 30 percent. Implementing FinOps allows businesses to accurately link and track spending to the right people, products, and processes. For example, managers can assign specific costs to different projects or departments, enabling better financial accountability and cost control.

#2 Data-Driven Budget Decisions

FinOps delivers greater insight into your spending, empowering you to make budget decisions supported by data.

- Pinpoint Overspending: Dive deep into the data and uncover those sneaky areas where your cloud budget is slipping away. With FinOps, enterprises can identify and address instances of overspending, be it through unused resources, idle instances, or suboptimal configurations.

- Optimize Resource Allocation: Bid farewell to resource wastage! With data-driven insights, FinOps helps companies optimize resource allocation. By analyzing usage patterns and performance metrics, businesses can ensure that each dollar they invest in the cloud is put to its best use.

- Align with Business Priorities: Say goodbye to arbitrary budgeting! FinOps allows enterprises to align their cloud spending with their business priorities. By leveraging data, business leaders can decide where to allocate their resources, ensuring that your cloud investment directly supports your strategic objectives.

But wait, there’s more! Did you know organizations embracing FinOps have reported up to 40% reduction in cloud costs within a year? That’s right! By harnessing the power of data-driven budget decisions, they’ve successfully tamed their cloud spending, making every dollar count.

#3 Competitive Advantage

Unlock the secret weapon of FinOps and gain an edge over your competitors. Here’s how it puts you ahead in the game:

- Unveil Cost-Saving Opportunities: With FinOps, managers become a master at spotting cost-saving gems. By diving deep into the data, businesses can discover hidden treasures like leveraging reserved instances or optimizing storage usage.

- Strategic Resource Allocation: Say goodbye to haphazard resource allocation! Cloud Financial Management empowers companies to strategically allocate their cloud resources. By analyzing usage patterns, performance metrics, and cost data, businesses can ensure that their resources are deployed where they make the most impact, giving an advantage in delivering top-notch services to their customers.

- Stay Ahead in the Market: By effectively managing costs and maximizing the value of cloud investment, businesses will have the flexibility and resources to outpace their competitors.

#4 Financial Stability and Predictability

Implementing Cloud Financial Management provides financial stability and predictability. Businesses can achieve better financial stability by optimizing cloud costs and ensuring efficient resource allocation. This, in turn, allows them to free up divisions and capital to be reinvested for innovation, driving growth and ensuring long-term sustainability.

Cloud FinOps: Pros & Cons of Cloud Financial Management

Pros:

- Cost Optimization: FinOps practices enable organizations to optimize their cloud costs effectively. By implementing resource allocation, rightsizing, and continuous monitoring, businesses can achieve significant cost savings and maximize their return on investment.

- Improved Financial Visibility: FinOps provides enhanced visibility into cloud spending, allowing organizations to track and analyze their expenses accurately. This visibility enables better budget management, cost allocation, and decision-making based on data-driven insights.

- Collaboration and Alignment: Cloud Financial Management promotes collaboration and alignment between IT, finance, and business teams. By involving these stakeholders in financial discussions and decision-making processes, organizations can bridge the gap between technical and financial aspects, leading to improved communication and cooperation.

- Faster Time-to-Market: With FinOps practices, organizations can streamline operations, automate processes, and leverage cloud resources efficiently. This results in faster product development and deployment cycles, enabling businesses to bring their offerings to market more quickly.

Cons:

- Learning Curve: Implementing FinOps requires a learning curve for organizations and teams unfamiliar with cloud financial management practices. It may take time to understand the concepts, tools, and processes associated with FinOps, potentially leading to initial challenges and delays in implementation.

- Cultural Shift: Adopting FinOps requires a cultural shift within an organization, as it involves breaking down silos between departments and encouraging collaboration. This shift may need more support from teams accustomed to traditional financial management practices.

- Complexity: Managing cloud costs and optimizing spending can be complex, especially in large-scale environments with diverse cloud services and multiple stakeholders. Organizations may encounter challenges in accurately tracking costs, identifying optimization opportunities, and implementing effective cost-management strategies.

- Tooling and Automation: To fully leverage the benefits of FinOps, organizations often rely on specialized tools and automation solutions. Selecting the right tools, integrating them into existing systems, and ensuring their compatibility with cloud platforms can be a complex process that requires careful evaluation and planning.

FinOps: Is It a Must-Have for Every Business?

There are numerous typical explanations for why your organization may not require FinOps. Assess your circumstances to determine if Cloud Financial Management can unlock further growth in your cloud operations. For instance:

- Self-Service Is Not Utilized

Some businesses do not employ a system where developers, app management engineers, data scientists, and other technical end-users can directly access cloud services through self-service. Instead, a centralized infrastructure and operations (I&O) team performs all cloud design and provisioning tasks. Alternatively, cloud requests are processed through a service catalog, where they undergo manual review and approval. Consequently, all activities within the cloud environment remain under the knowledge and control of the central I&O team, allowing organizations to maintain budget management practices similar to those employed in an on-premises setup. - There Is Minimal Variability In Production

For example, applications are assigned a fixed amount of infrastructure, and/or their usage follows a highly predictable pattern (for instance, they scale up automatically during the final week of each month and down afterward). As a result, the monthly cloud cost for each application remains consistently similar. Setting up budget alerts to address any unexpected usage spikes is still advisable. Still, such incidents are likely to be infrequent and occur primarily during the initial deployment of the application, perhaps requiring an annual review. - Cloud Frugality: Cloud Spending Is On The Lighter Side

Suppose a business’ cloud spending is not substantial. In that case, even a notable percentage reduction in costs (which could potentially be achieved by discontinuing unused cloud dev/test VMs and simply turning them off) won’t result in significant monetary savings. Implementing automation that automatically hibernates or de-provisioning idle infrastructure may offer a worthwhile return on investment. However, employing a manual approach that involves numerous individuals, either through paperwork or directly manipulating the infrastructure, is likely to consume more labor time and incur greater expenses than it saves in cloud costs. - No Infrastructure-Hungry Apps

In the wild enterprise world, companies often lack those supercharged, cloud-native apps that digital-native folks thrive on. They might only have a handful of them, if any. Hold on tight because here’s the catch: even if your cloud spending is no small change, it’s spread thin across countless small-scale apps — it could be dozens, hundreds, or even thousands of them! So, here’s the deal: even slashing an app’s capacity in half won’t give you jaw-dropping monthly savings. The effort won’t match the reward.

Bonus: 5 most popular Cloud Financial Management Software

Best for: Enterprises with complex cloud environments

Pricing: The platform requires website visitors to request a custom quote. Pricing is for each feature per month, starting at $1,500/month.

Key features: Budgeting, forecasting, rightsizing, and reporting.

Pros: Powerful features, easy to use, integrates with multiple cloud providers

Cons: Can be expensive, not as good for small businesses

Best for: Enterprises that want to optimize their cloud costs

Pricing: Starts at $1,200/month

Key features: Budgeting, forecasting, rightsizing, and compliance reporting

Pros: Powerful features, visualization tools, easy to use, integration with multiple cloud providers.

Cons: Can be expensive, not as good for small businesses

Best for: Businesses and individuals already using Amazon Web Services.

Pricing: Free for AWS users

Key features: Ability to view data up to the last 13 months and forecast how much you’re likely to spend over the next three months. Reserved Instance (RI) reporting for visualization of RI usage and coverage.

Pros: Free to use, direct integration with your AWS environment, precise cost information, powerful forecasting.

Cons: As a native AWS tool, it does not provide insights into costs across different cloud platforms (like Google Cloud or Azure).

Best for: Organizations of all sizes already using Microsoft Azure.

Pricing: Free for Azure users.

Key features: Cost monitoring, budgeting, forecasting, cost allocation, and reporting.

Pros: Free to use, powerful features, easy to use, integrations with other Azure services.

Cons: Can be complex to set up, especially for organizations with large and complex cloud environments, and does not provide insights into costs across different cloud platforms (like Google Cloud or AWS).

Best for: Organizations of all sizes that use Google Cloud Platform.

Pricing: Is free for all Google Cloud Platform (GCP) customers.

Key features: Cost monitoring, Budgeting, Forecasting, Cost allocation, and Reporting.

Pros: Free to use, Powerful features, Easy to use, Integrates with other GCP services.

Cons: Can be complex to set up, not as powerful as some third-party tools, and does not provide insights into costs across different cloud platforms (like Azure or AWS).

Final thoughts

In the ever-transforming realm of cloud computing, conquering the art of financial management has emerged as an absolute must for organizations. By harnessing the potent forces of Cloud Financial Management, businesses can unleash the full potential of their cloud spending, making shrewd budgetary choices driven by data and gaining a formidable edge in the cutthroat world of competition.

Embracing FinOps may present its fair share of challenges, such as a learning curve and a cultural metamorphosis, but fear not, for the rewards are well worth the adventure. Let the boundless benefits of FinOps empower your organization to navigate the intricate realm of cloud expenditures, propelling innovation and growth to dazzling new heights!